Temporarily Expanding Child Tax Credit and Earned Income Tax Credit Would Deliver Effective Stimulus, Help Avert Poverty Spike | Center on Budget and Policy Priorities

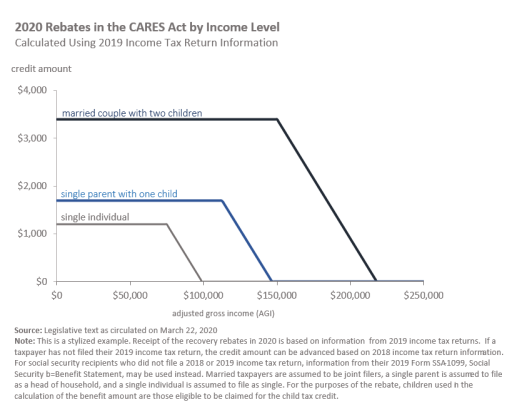

COVID-19 and Direct Payments to Individuals: Summary of the 2020 Recovery Rebates in the CARES Act, as Circulated March 22 - EveryCRSReport.com

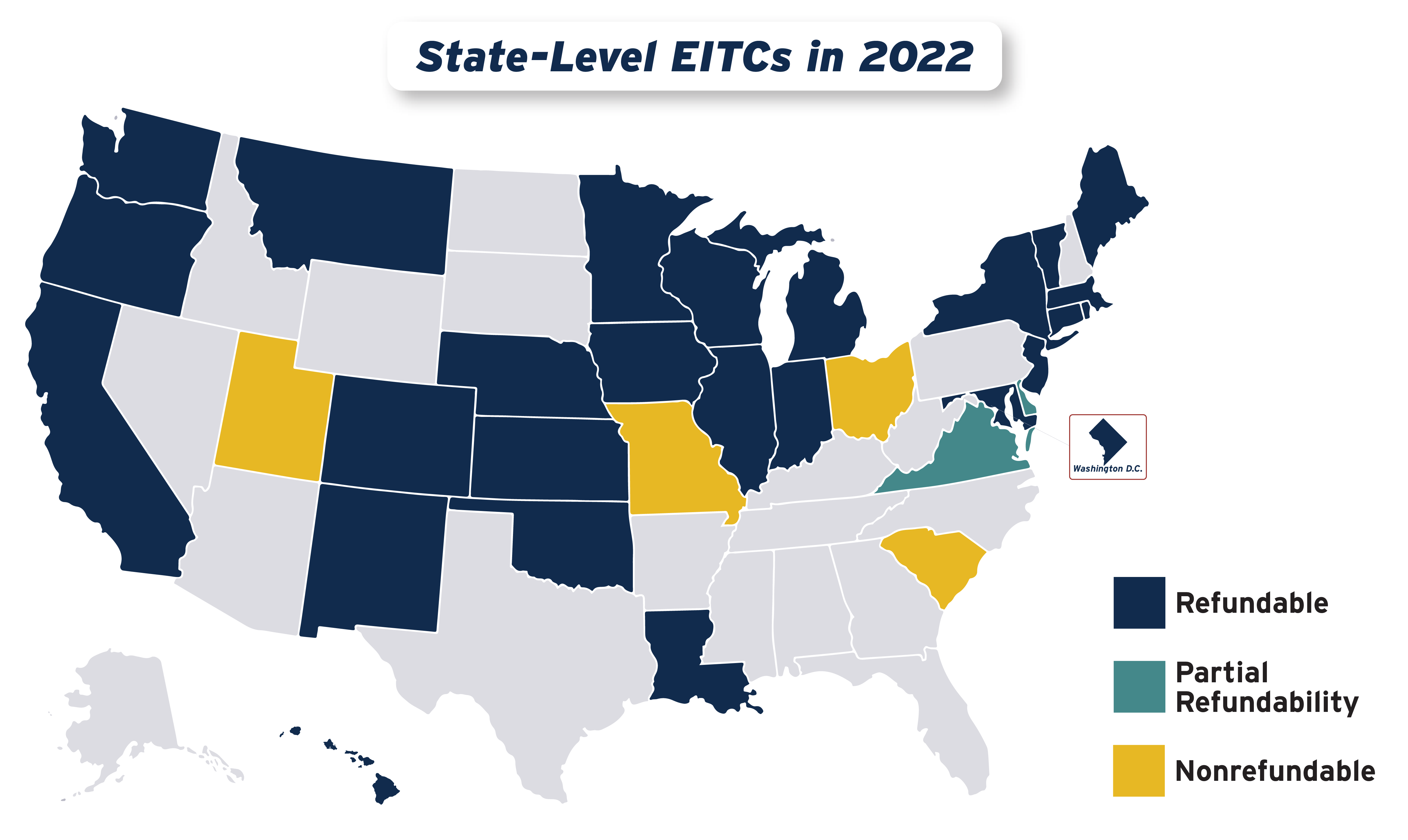

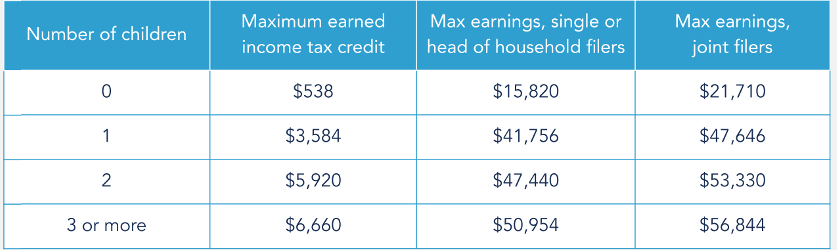

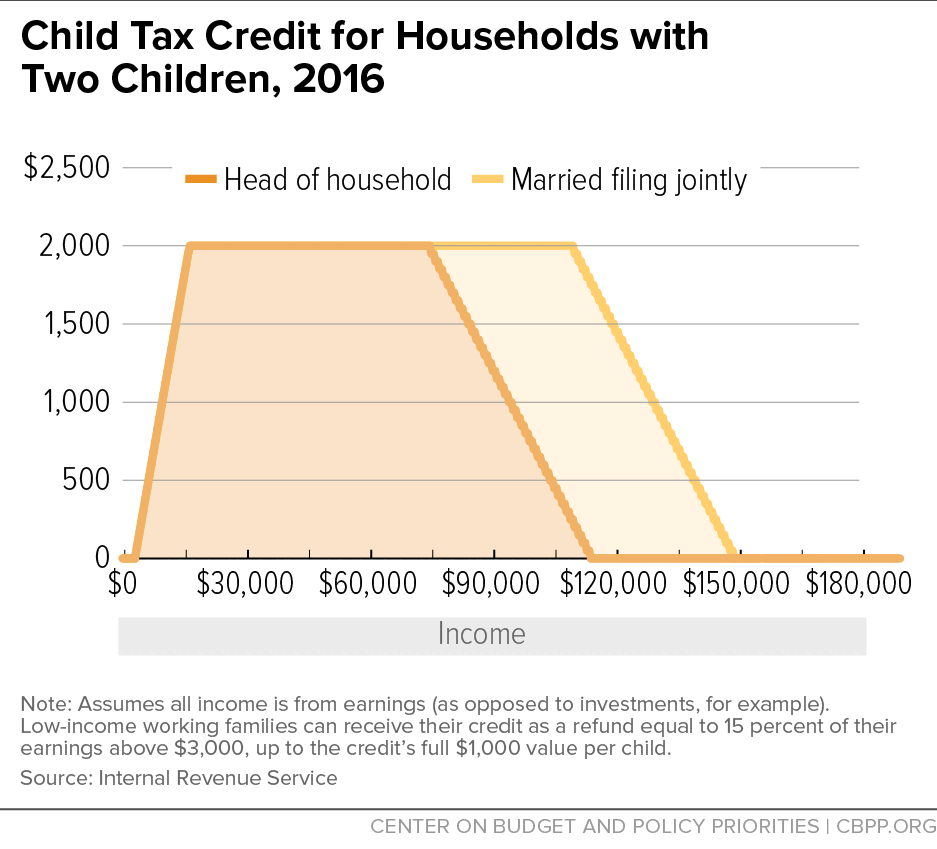

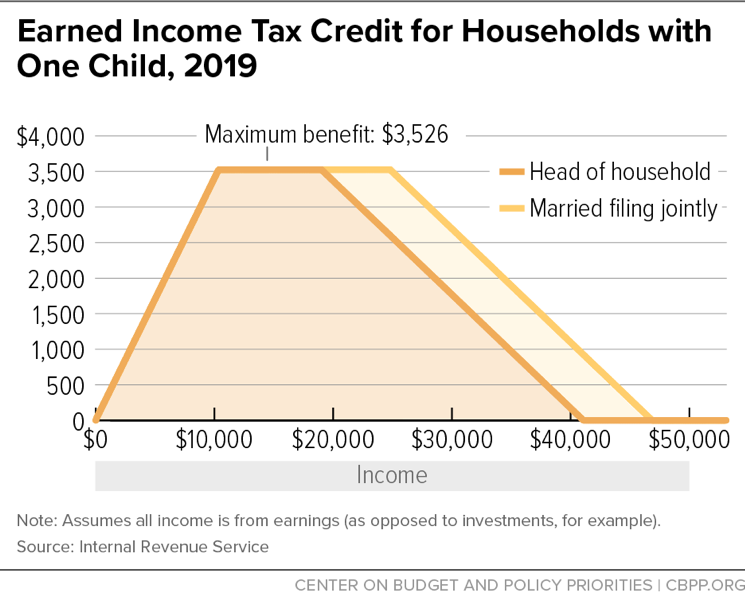

Chart Book: The Earned Income Tax Credit and Child Tax Credit | Center on Budget and Policy Priorities

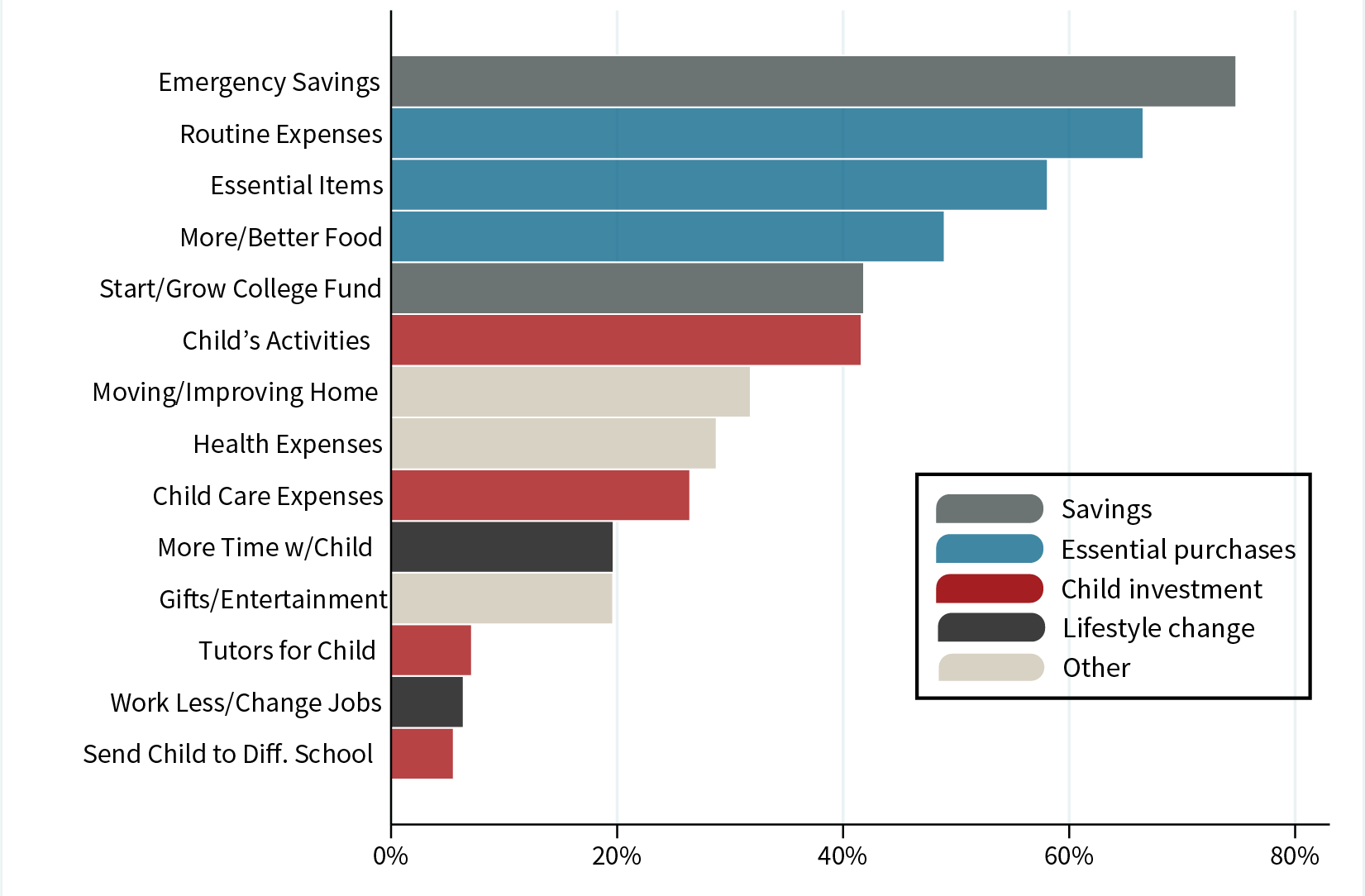

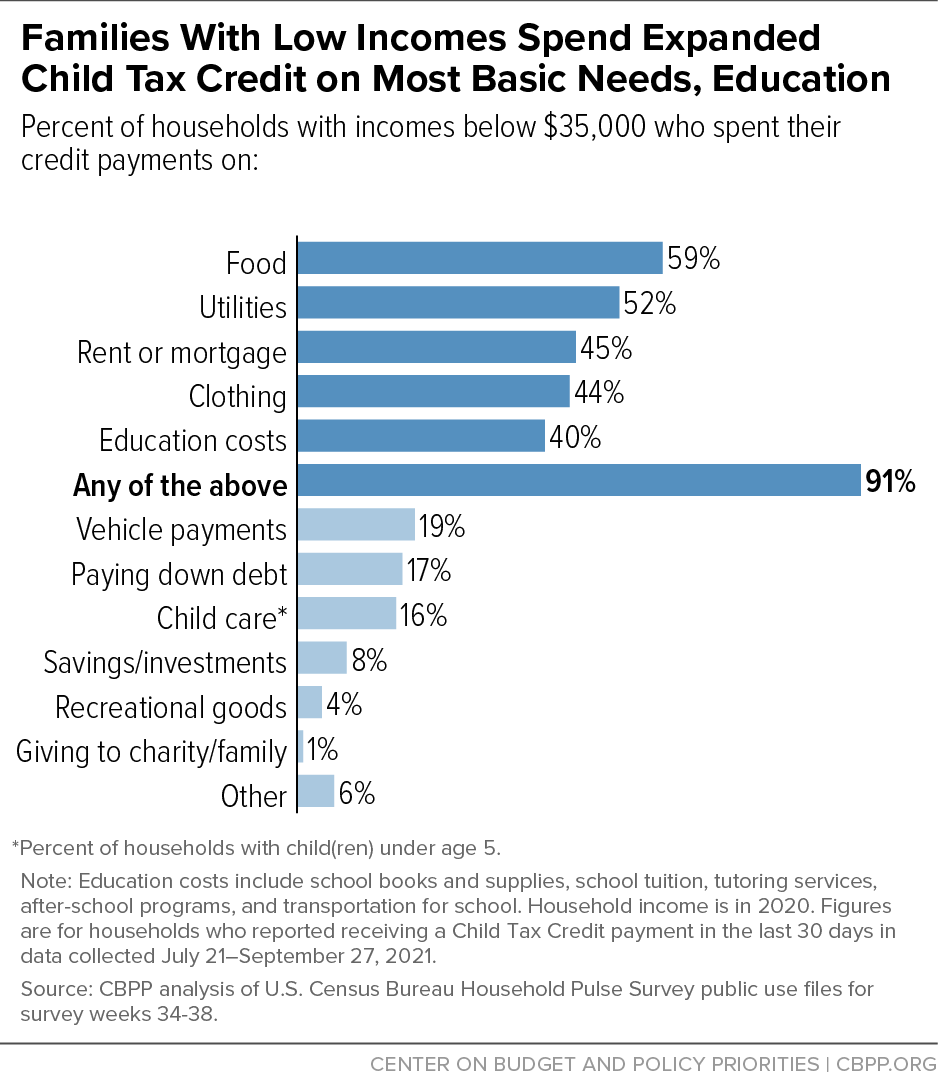

9 in 10 Families With Low Incomes Are Using Child Tax Credits to Pay for Necessities, Education | Center on Budget and Policy Priorities

Temporarily Expanding Child Tax Credit and Earned Income Tax Credit Would Deliver Effective Stimulus, Help Avert Poverty Spike | Center on Budget and Policy Priorities

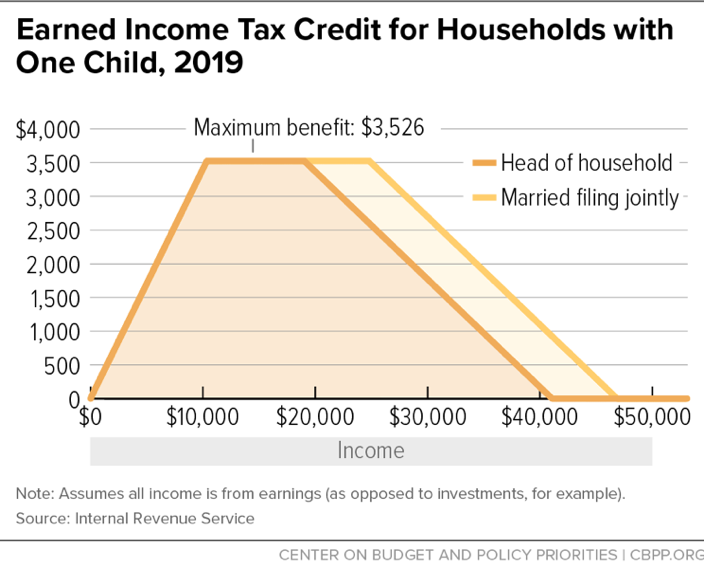

Earned Income Tax Credit for Households with One Child, 2019 | Center on Budget and Policy Priorities

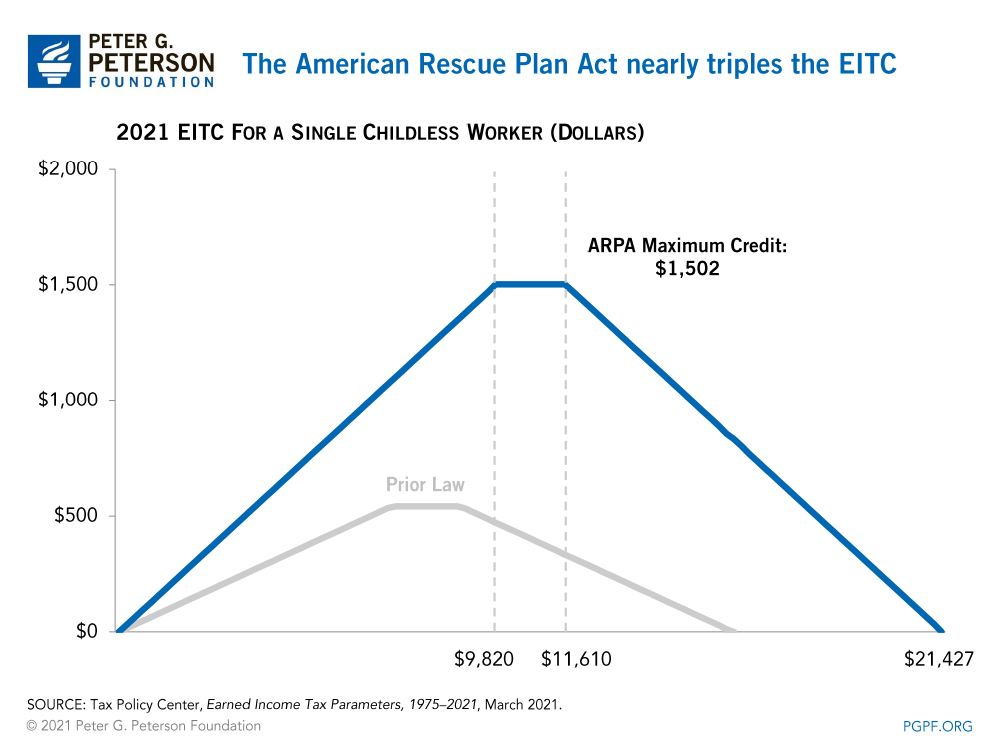

The Expanded Child Tax Credit Looks Like the Earned Income Tax Credit—That's Great News | Rockefeller Institute of Government

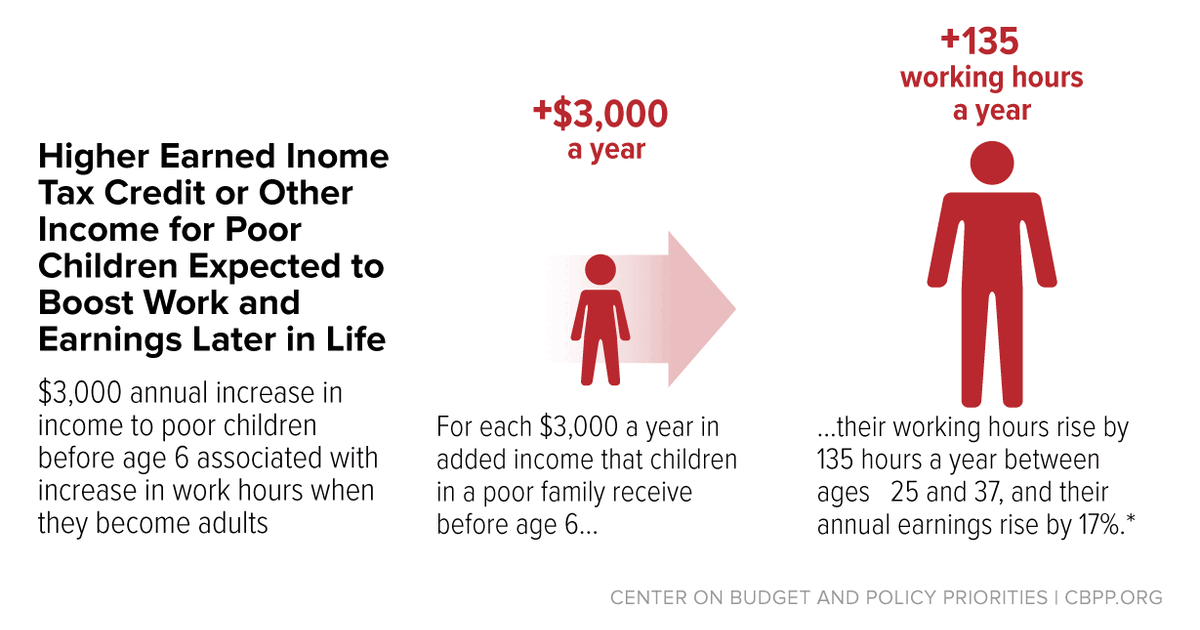

EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children's Development, Research Finds | Center on Budget and Policy Priorities

.png)