MMT meets Rey's dilemma: a balance sheet view of capital flight (coming soon to an EM country near you) – Critical Macro Finance

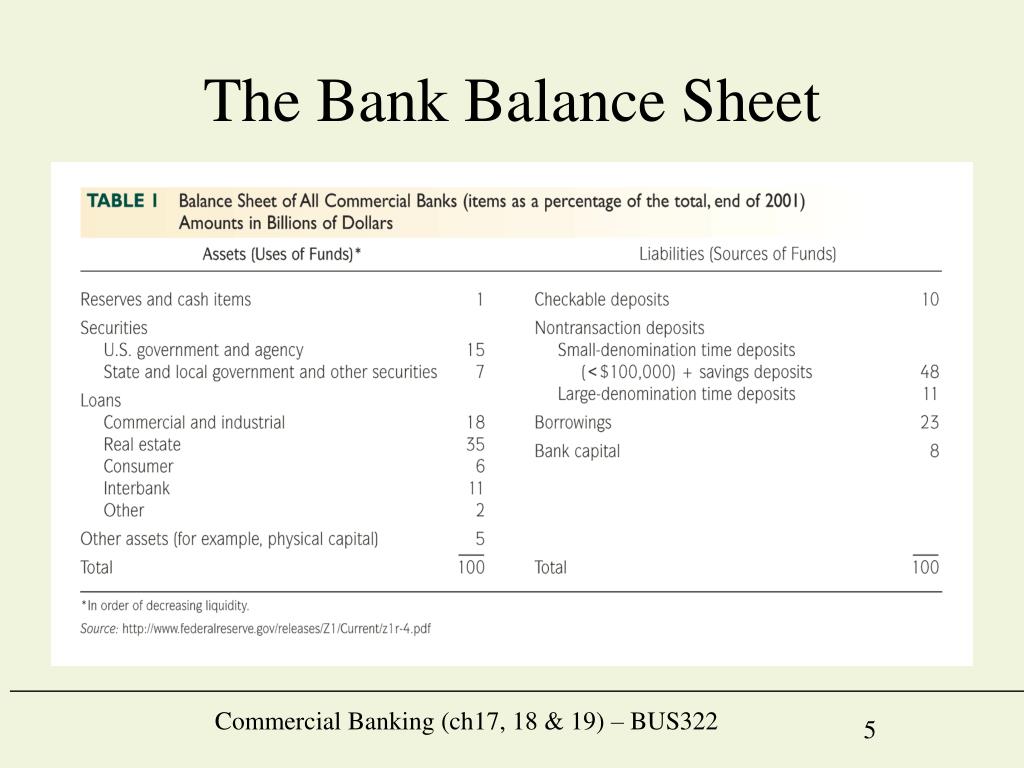

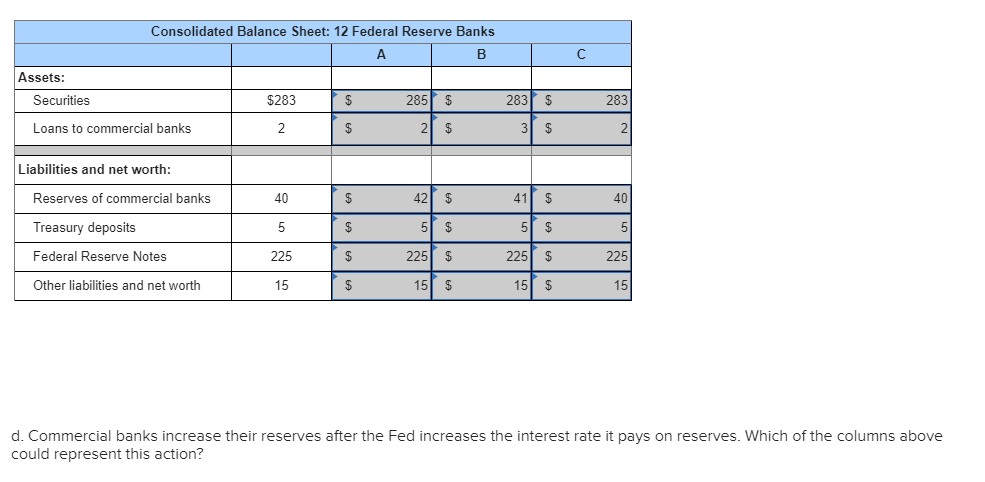

CBL reveals a summary of the Consolidated Commercial Banks' Balance Sheet in its Main Financial Data and Indicators of Banks ( 1st Quarter of 2023) - Tabadul TV

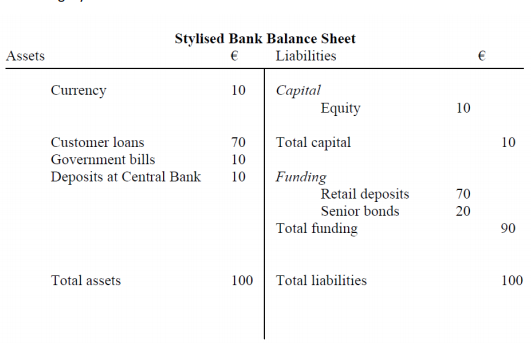

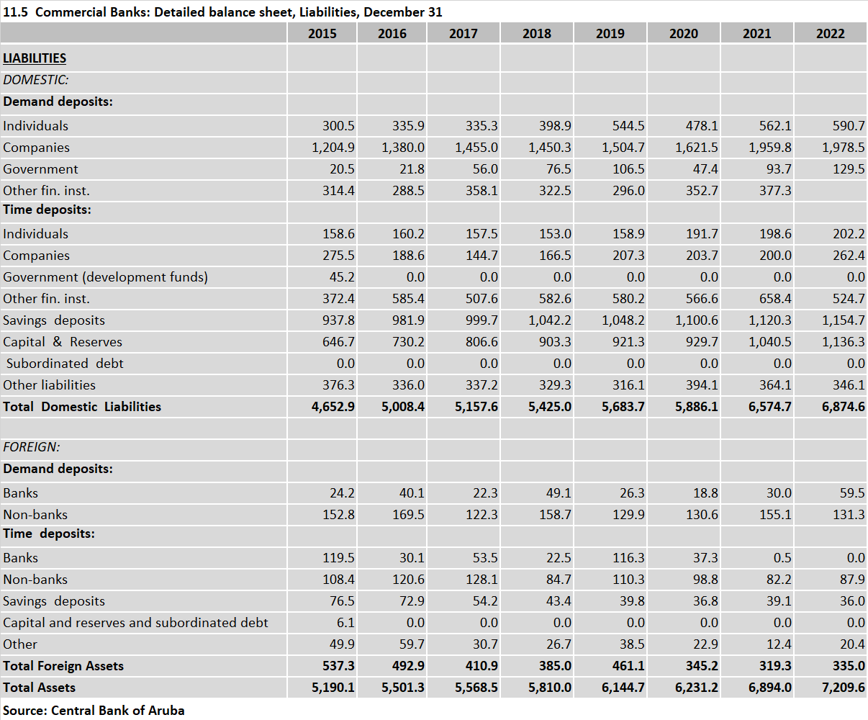

Commercial Banks detailed balance sheet, liabilities, December 31, 2019-2022 – Central Bureau of Statistics

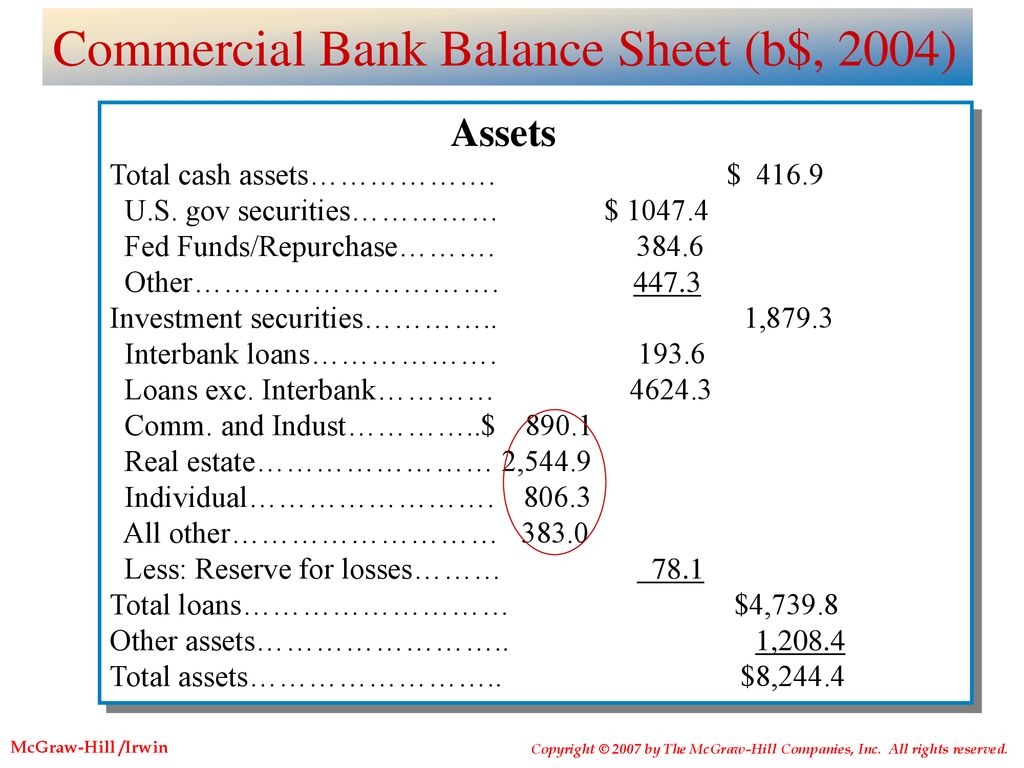

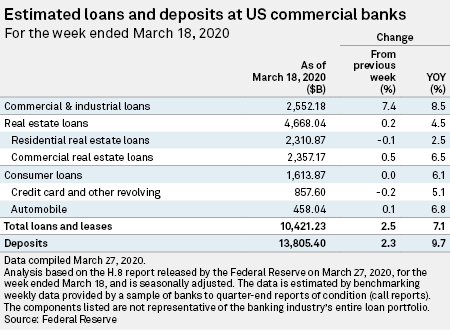

US bank balance sheets swell with commercial loans and Fed liquidity | S&P Global Market Intelligence

![Economics] What is Understanding Balance sheet of a Commercial Bank Economics] What is Understanding Balance sheet of a Commercial Bank](https://d1avenlh0i1xmr.cloudfront.net/775196c2-41d1-4e4b-8375-e87ae25ac777/different-assets-and-liabilities-of-a-commercial-bank---teachoo.jpg)

![Economics] What is Understanding Balance sheet of a Commercial Bank Economics] What is Understanding Balance sheet of a Commercial Bank](https://d1avenlh0i1xmr.cloudfront.net/d41d2102-4f84-4785-90c3-817a96d6ad2b/balance-sheet-of-a-company-vs-balance-sheet-of-bank---teachoo.jpg)